In today’s fast-paced world, the importance of early employment cannot be overstated. With growing concerns over unemployment rates, especially in India, where approximately 12 lakh engineers graduate each year, many face the daunting challenge of joblessness. However, those who secure employment early on in their careers often enjoy a faster path to financial independence. In

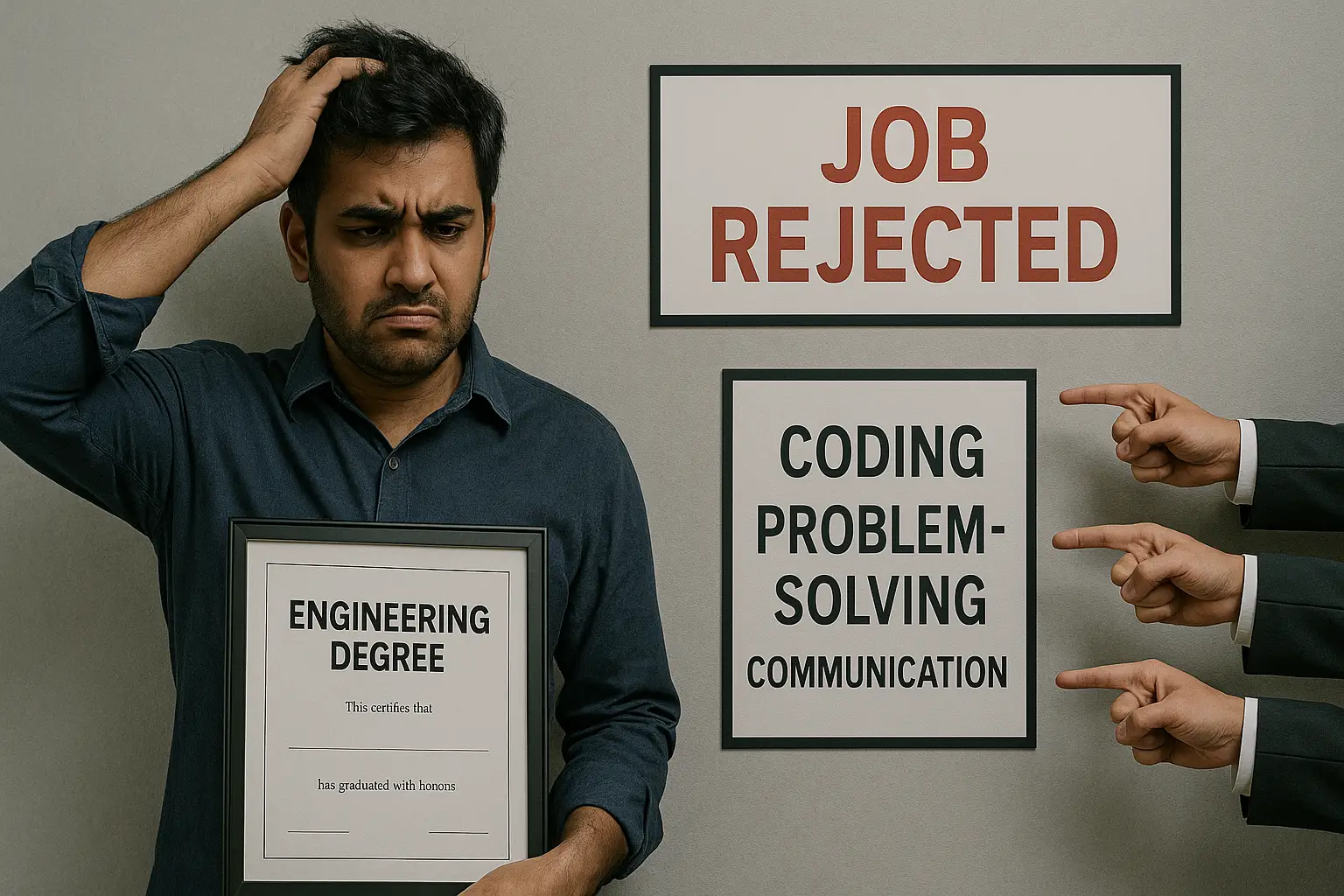

In today’s fast-paced world, the importance of early employment cannot be overstated. With growing concerns over unemployment rates, especially in India, where approximately 12 lakh engineers graduate each year, many face the daunting challenge of joblessness. However, those who secure employment early on in their careers often enjoy a faster path to financial independence. In this article, we’ll explore how early employment can fast-track your financial freedom, focusing on the ROI of employability, salary growth, and the costs of unemployment.

1. The ROI of Employability: A Key to Financial Freedom

In the modern economic landscape, employability is one of the most valuable assets a person can have. The return on investment (ROI) from securing a job early goes far beyond just financial compensation. Here’s how early employment can contribute to your long-term financial growth:

1.1 Accumulating Experience & Skillsets

The earlier you enter the workforce, the sooner you start accumulating valuable experience and skills. Whether it’s in the corporate world, an entrepreneurial venture, or a technical field, this early experience contributes to career advancement. The longer you wait to enter the job market, the more you miss out on learning, developing, and honing your skills—skills that employers pay for. This experience acts as a foundation for future promotions, raises, and opportunities.

1.2 Increased Earning Potential

The longer you stay employed, the more you can climb the salary ladder. In fact, early employment gives you a head start on this journey. Research shows that individuals who begin their careers early can outpace their peers in salary growth by 10-15% in the long term. Additionally, early starters are more likely to receive the opportunity for salary raises, promotions, and more complex job responsibilities. The longer you delay your entry into the workforce, the longer it will take to achieve these benefits.

1.3 Building a Strong Network

Employment brings more than just a paycheck; it opens the door to an expansive professional network. From mentors to colleagues, this network can offer support, resources, and future opportunities. Networking early in your career gives you an upper hand when seeking new positions, promotions, or launching your own business. Relationships established during your early years can lead to valuable mentorship and career insights that would be harder to access later on.

2. Salary Growth vs. Unemployment Costs: A Crucial Comparison

One of the primary reasons why early employment fast-tracks financial freedom is the stark difference between salary growth and the costs of unemployment.

2.1 The Hidden Costs of Unemployment

While it may seem tempting to take a gap year or wait for the “perfect job,” the cost of unemployment can be significant. Unemployment isn’t just about the loss of income—there are psychological and financial costs associated with being out of the job market. Studies show that individuals who experience long periods of unemployment often face lower future earning potential and can fall behind in terms of career growth.

-

Unpaid Debt: Living without a consistent income stream leads to relying on savings or credit, leading to debt accumulation. This can take years to pay off, slowing your ability to build wealth and invest in long-term assets like property, stocks, or retirement funds.

-

Lost Opportunities: Every year you spend unemployed is a year of missed opportunities for career growth, skill-building, and networking. This creates a “time gap” that takes years to recover from.

-

Skills Atrophy: Over time, if you don’t keep your skills fresh or develop new ones, you become less competitive in the job market. Employers value those who continually adapt and grow, so the longer you’re unemployed, the more difficult it becomes to catch up with the rest.

2.2 The Benefits of Early Salary Growth

In contrast, securing a job early means steady salary growth and compounding financial benefits. Early employment provides the opportunity to:

-

Build a Financial Safety Net: Starting work early allows you to save and invest earlier, which compounds over time. The earlier you begin investing, the more wealth you can accumulate over time through compound interest and market growth.

-

Employer-sponsored Benefits: Many employers offer additional benefits such as health insurance, pension plans, and bonuses. These perks not only help with daily expenses but also enhance your long-term financial security.

-

Job Security & Stability: Early employment often leads to greater job stability, which provides the foundation for a secure financial future. Companies tend to reward loyal employees with raises, bonuses, and more significant responsibilities, contributing to long-term income growth.

3. How Employment Impacts Financial Decision-Making

Having a steady income from an early age empowers individuals to make informed financial decisions. With consistent earnings, you can start budgeting, saving, and investing for the future, which accelerates your financial independence. Here’s how early employment contributes to better financial decision-making:

3.1 Improved Creditworthiness

A steady income enhances your creditworthiness, which in turn, helps you secure loans at better rates. Whether you’re looking to purchase a car, house, or start a business, having a stable job ensures that you can access better financing options. A higher credit score opens doors for more significant financial opportunities, allowing you to make smarter investments.

3.2 Building Long-term Assets

Early employment allows you to invest in long-term assets such as property, stocks, or retirement plans. The earlier you start, the more you can leverage compound interest to build wealth. Instead of waiting for a dream job or a windfall of cash, early career professionals often find themselves in a position to buy their first home or start investing in the stock market much sooner than their peers.

4. Final Thoughts: Securing Your Future Through Early Employment

In conclusion, early employment offers not only financial rewards but also a solid foundation for long-term wealth-building. The ROI of employability is clear: accumulating experience, growing your salary, and avoiding the costs of unemployment all contribute to faster financial freedom. By stepping into the workforce early, you position yourself to make informed financial decisions, increase your earning potential, and achieve financial independence quicker than if you delay your entry.

If you’re looking for practical ways to fast-track your financial freedom, consider embracing early employment as a critical strategy.

Leave a Comment

Your email address will not be published. Required fields are marked with *